30% returns means

10X your money in 10 years

“Nice to meet you.

I'm here to mentor a few serious, aspiring angel investors.

Imagine waking up to these headlines about your portfolio companies!”

– Cliff

“Railsbank raises $70M to build out its fintech-as-a-service platform” (Techcrunch, 2021)

MyRepublic seals USD51.7m cash injection from Makara Capital” (CommsUpdate, 2017)

Now imagine having 21 super-talented entrepreneurial teams all working simultaneously to hyper-grow their startups -- with you having a stake in all of those companies. Of course not all will succeed -- but if you’ve invested well, enough of them will, generating high overall returns.

30% RETURNS BUILDS WEALTH FAST: 10X YOUR CASH INVESTED IN 10 YEARS

I will share how I built real wealth through exceptional returns as an angel investor. My portfolio has grown 30% annually since 2012, a 6x multiple on cash invested, driven by direct investments in startups that have received $250m in follow-on funding and are now collectively worth $1b+. Public info easily corroborates this (see profile document “Portfolio Performance”).

Consistent 30% returns will 10X your money in 10 years, beating the returns of almost any other investment strategy (see profile document “Venture Investing Builds Wealth Faster”).

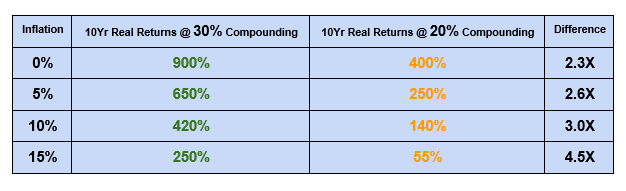

Why should you only consider a mentor with the highest provable performance? Compounding and inflation. 30% vs 20% annual returns compound to very different outcomes over 10 years, even more so with inflation

Benefits of Angel Investing

Financial independence (fast wealth-building)

Location independence (live anywhere)

Gain full control over your time

Stimulation (new ideas, visionary entrepreneurs, making a difference)

Satisfaction of being a key driver of real innovation

Apply skills, knowledge in new contexts

Expand your network, meet other investors, find even more opportunities

A 20% return is certainly good, but 30% is wealth-building (and a far better defense if inflation rips).

IS ANGEL INVESTING RIGHT FOR ME?

How do you know if it’s right for you?

How do you get started?

How can you generate high returns?

I believe anyone with solid business experience, an inquisitive mind, some tech savvy, decent risk tolerance and discipline can do well.

Tech executive plotting an escape from corporate life (like I was)? Functional expert with ideas of how innovation could transform your domain? Finance pro trying to grasp the tech opportunity, or break into the much higher upside potential of early vs. late stage? Just a few examples among many (see disclaimer* for which profiles aren’t appropriate).

I’ve already helped six people make their first angel investments, and I can help you too

Common Myths and Limiting Beliefs about Angel Investing

(all either false, or can be mitigated fairly easily)

Seems too risky

Difficult asset class to understand

Sounds too time-consuming to execute

I don’t live near any big startup ecosystems

Virus restrictions make in-person due diligence a challenge

Not sure I have any special insight to invest well

All the good opportunities are probably taken

I wouldn’t know how to evaluate companies

I don’t think companies would be interested in my small investment amounts

Not sure I have the skills to help a startup after investing

Not sure I have the discipline to construct a broad portfolio

Keys to my success:

1) A systematic portfolio approach

2) Investing initially in areas I knew well

3) Honing my evaluation skills to surface truly great opportunities

Many new angel investors miss one or more of the above, make a few mediocre investments, then stop, never understanding what they did wrong.

WHY I’M DOING IT

Why am I offering to mentor? Fair question, as every genuinely high-performing venture investor can make more money investing than mentoring. (Keep in mind that while brand name investment experience is nice, it’s only a weak proxy for performance; and provable performance is what matters.)

Three main reasons:

1) I’m writing a book on angel investing

2) I firmly believe that the skill can be taught

3) I’ve enjoyed mentoring throughout my career

Also, the world needs more angel investors, particularly in less developed ecosystems, so it's a way of giving back.

Working intensively with a few (max 3 at a time) committed folks from different backgrounds will ensure the book’s broad relevance.

My Story

I was nearing 40 and had a great job at Google, climbing the ladder, getting paid well, and enjoying the team and my work in it. I also liked my boss. In short, all was well. But the memory of my first year never left me -- managing key partner accounts for large telcos, stuck in the middle of all the politics between those telcos, deal-obsessed department heads, and a tricky product team based 8 time zones away struggling to meet partner demands (some reasonable, some not).

I knew then I was having a good run after a challenging first year, but I also knew that run couldn’t last forever. While I was navigating well, I wasn’t really a “corporate” person and I couldn’t see myself staying forever. And despite the great income, it wasn’t going to be quite enough, soon enough, for real financial independence.

I imagined my ideal lifestyle and the kind of work that might enable it, and I thought might be able to leverage my background (I had been a venture-backed entrepreneur and worked for several startups before Google) and skills (I had a decent financial background and strong commercial and operational skills in tech) into angel investing. Knowing that I wasn’t getting any younger and that it was a long game -- often 10 years until meaningful exits and cash back out -- I knew if I was going to do it, I needed to get started right away. I had many of the limiting beliefs listed in the box above, but I pushed through them all and realized they weren’t the obstacles I had thought they were. And now, nearly 10 years later and with Google in the rear view mirror, I’ve constructed the ideal life that I wanted!

MORE ABOUT ME

Named among top FinTech angel investors in Europe

Venture Partner at Series B+ fund

Board Director / Advisor

ex-Google exec (leader of 9-figure business unit)

Former venture-backed entrepreneur

INSEAD MBA

WHAT YOU’LL LEARN

I have a 20-25 hour curriculum to instill the knowledge and confidence to make your first investment. Pay-as-you-go, a-la-carte are also fine. I will naturally tailor every engagement for maximum value. Example topics, in rough expected order:

-

Comparing venture to other investment strategies/assets

-

Assessing your true risk tolerance

-

Converting your expertise into an investing 'edge'

-

How to plan a diversified portfolio

-

Building quality deal-flow and an individual investor ‘brand’

-

Sharpening your judgment to know what 'great' opportunities look and feel like

-

Approaching and due-diligencing an opportunity, incl. benchmarking KPIs

-

Fairly valuing startups (even pre-revenue)

-

Investment terms: what’s standard, what should & shouldn’t be negotiated

-

What’s needed to confidently ‘pull the trigger’ on a first investment

-

Bringing other investors on board

-

Building reputation through post-investment value-add

-

Making follow-on investments

-

Angel liquidity rounds and exit

Self-teaching:

This was my method. Learned a lot, but some of it was certainly inefficient, and I learned the hard way on certain investments, losing money in the process. There is certainly a ton of useful information out there, but it’s not well-curated, quality varies, and deeply pragmatic advice tailored to you is typically lacking, because the advice is typically content marketing to get you to buy something else.

Outsource by investing in angel funds:

Not a bad way to get started, and for some investors funds can be a great way to accelerate portfolio diversification. But only direct investing into startups trains the deep evaluation skills to drive high returns that are under your control.

Investing club boot camp:

I’ve seen one advertised for $4,500, but it seems to be affiliated with an investing club that then wants you to invest in their dealflow. Don’t know if this is the typical model, but unless the club has a great investing track record and the decision-makers are the teachers, value-for-money might be a challenge.

Getting a mentor:

I believe this is the best way, because tailored one-on-one help is highly efficient, and the inherent interactivity and availability can make all the difference. But frankly, few who are optimally qualified to offer such a service (they’re busy investing!). If they do, keep in mind that mere “experience” in venture is insufficient. End-to-end investment decision-making and a very strong individual track record are essential for best results.

WORKING TOGETHER

How much is this expertise worth? Imagine a $5k investment in venture education helps you avoid a total loss on one $10k direct investment, replaced with one ‘decent’ (3x or $30k cash back) investment. $30k vs. $5k invested. Of course, the benefits can be much, much larger.

Get in touch at [email protected]

Rates:

Pay-as-you-go, $250/hr, minimum 1 hour.

Full 20-25hr course: discounts available.

INFOGRAPHIC ON STEELE VENTURES INVESTMENT FUND

Fund Performance

6X multiple on cash invested at mid-2021

30% IRR from 2012 to mid-2021: Among global top 25% performing venture funds (Pitchbook benchmarks)

Ultra-low 25% of invested cash lost (realized & anticipated)

Portfolio Highlights

$1b+: Aggregate value of portfolio companies (@ last round)

$250m+: Capital raised by portfolio companies

84%: Companies receiving follow-on funding

Notable follow-on or co-investors:

Portfolio Overview

21: Companies in portfolio

5: Countries invested in (UK, USA, Singapore, Italy, Spain)

12, 6, 5, 4: Investments in Marketplaces, FinTech, SaaS and Other businesses (respectively; some overlap)

Portfolio Impact

1,000+: Aggregate jobs created by portfolio companies

8: Investments with clear positive social impact

Success Stories

"If I'm going to do this then Cliff is going to be

the person to help us figure out how to do it..."

"We got a good start through you, and the work you did to help us understand how to do it...that process was very smooth."

"I feel like I have a little playbook now that I could deploy."

"Very happy I've done it."

Disclaimer: None of the above is financial advice. Consult a financial advisor. At a minimum, you should be an accredited investor (or legal equivalent) with ~$50k to invest, representing a small % of your net worth.